The Tax Payer in South Africa

There a two types of taxes in South Africa; Direct and Indirect taxes. Direct taxes are taxes paid by the taxpayer directly to the government, whereas indirect taxes are taxes levied on the supply of goods and services.

Taxes in South Africa:

Direct Taxes: Personal Income Tax, Capital Gains Tax, Dividends Tax etc

Indirect Taxes: VAT, Transfer Duty, Excise Duties & Levies etc

There’s always a furore by the “taxpayers” because they assume they are paying for the Grant recipients; there’s a strange if not absurd correlation created that then leads to bickering. Its generally accepted that “taxpayers” in South Africa refuse to support a welfare state and the recipients therein.

The 2024 Budget sets out the tax collection in South Africa:

The 2023 SARS Statistics are set out as follows (2024 is unavailable):

The number of active income taxpayers is around 14 million

In short there are ~25m registered individuals and ~14million active taxpayers.

Of the ~14m active taxpayers, just less than half about 6.8m South Africans do not earn more than R96K per annum and are therefore not liable for Personal Income tax.

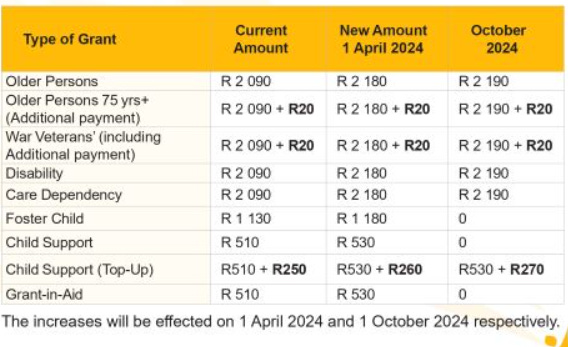

There are various grants provided by the State to about 19 million people:

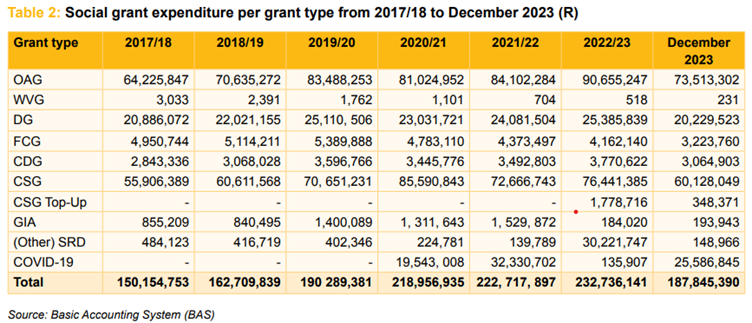

The total spend on Social Grants is about R232 billion (2023)

The Total spend on Social Grants in the 2024/5 Budget is around R387 billion:

Conclusion

In summary; there are 14 Million personal tax payers in South Africa, and 19 million people on social grants. Ideally these numbers should be reversed but that would require a massive industrial push.

Social Grants cost the State about R387 billion however VAT receipts (which every South African pays) are well in excess of R476 billion.

If South Africa could create 5 million jobs and thereby increasing the Personal Income tax base and simultaneously the VAT base this would lessen the “burden” on the fiscus and reprioritise funds elsewhere.